Loading

Get Interactive W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Interactive W 9 Form online

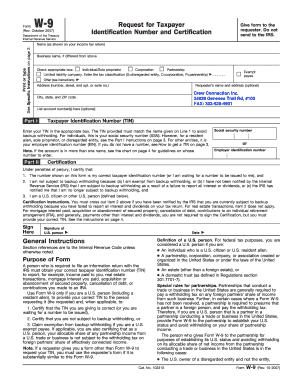

Completing the Interactive W 9 Form online is a straightforward process that allows you to provide your taxpayer identification number efficiently. This guide will walk you through each step to ensure accuracy and compliance with IRS requirements.

Follow the steps to fill out the Interactive W 9 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name exactly as it appears on your income tax return in the top field labeled 'Name'. If you have a business name that differs from your personal name, enter it in the 'Business name' field.

- Select the appropriate box that describes your entity type, such as Individual/Sole proprietor, Corporation, Partnership, or Limited liability company. If you choose LLC, indicate the tax classification (D for disregarded entity, C for corporation, P for partnership).

- Fill out your address details in the 'Address' section, writing your street number, street name, apartment or suite number, city, state, and ZIP code.

- In 'Part I', enter your Taxpayer Identification Number (TIN). For individuals, this is your Social Security Number (SSN). If you are a corporation or other entity, use your Employer Identification Number (EIN). Ensure the TIN matches your name to avoid backup withholding.

- In 'Part II', you must certify your information under penalties of perjury. Read through the certification statements carefully and check the box that applies to you. Be sure to cross out item 2 if you have been notified by the IRS about backup withholding.

- Sign the form in the designated 'Signature' area, and include the date that you are completing the form.

- After filling out the form, review it thoroughly for accuracy and completeness. You can then save your changes, download, print, or share the form as needed.

Start completing your Interactive W 9 Form online today to ensure timely and accurate tax reporting.

Yes, the IRS currently accepts e-files for many tax forms, including the Interactive W 9 Form. This method helps streamline your filing process and reduces the likelihood of errors. Ensure you meet the necessary requirements for submission and check for any updates on the IRS website. E-filing remains a secure and efficient option for most taxpayers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.