Loading

Get Rollover/transfer Out Form - Ncompliancelegacy.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ROLLOVER/TRANSFER OUT FORM - Ncompliancelegacy.com online

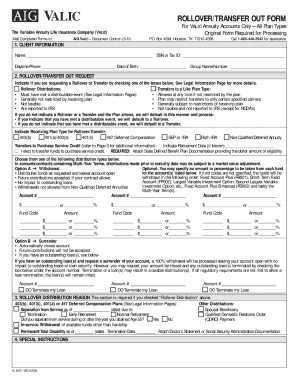

Completing the ROLLOVER/TRANSFER OUT FORM is a key step in managing your financial assets efficiently. This guide provides a structured approach to help users accurately fill out the form online, ensuring a smooth transfer process.

Follow the steps to complete the ROLLOVER/TRANSFER OUT FORM effectively.

- Select the 'Get Form' button to access the ROLLOVER/TRANSFER OUT FORM. This action will open the document for you to edit.

- Begin by filling out your personal information in the designated fields, including your full name, contact number, and email address. Ensure that all details are accurate to prevent any delays in processing.

- Proceed to the section requesting details of your current account. Input the account number and the financial institution's name. Double-check that the account information matches your records.

- In the next section, indicate the type of transfer you are requesting, whether it is a rollover to another qualified account or an outright transfer. Select the appropriate option based on your financial situation.

- If applicable, provide information about the new receiving account, including the account number and the financial institution’s details to ensure a smooth transition.

- Review the form carefully to confirm all information is correct and complete. Make any necessary changes before finalizing your submission.

- Once you are satisfied with the form, you can save your changes, download a copy for your records, print it, or share it as needed.

Complete your ROLLOVER/TRANSFER OUT FORM online today for a hassle-free asset transfer!

Related links form

Processing a 401k rollover involves a few key steps. Begin by obtaining your ROLLOVER/TRANSFER OUT FORM from Ncompliancelegacy and submitting it to your current plan provider. Afterward, confirm the transfer details with both your current and new retirement accounts. Prompt communication can help ensure a timely and efficient rollover process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.