Get It 2663 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 2663 2012 Form online

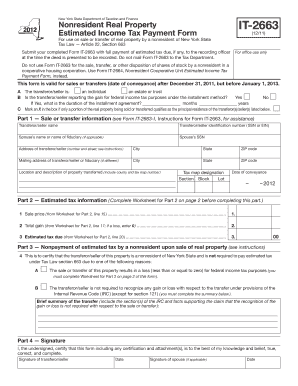

The It 2663 2012 Form is essential for nonresident individuals, estates, and trusts when estimating personal income tax on the sale or transfer of real property in New York State. This guide provides a comprehensive overview and clear, step-by-step instructions for completing the form online, ensuring a smooth filing experience.

Follow the steps to accurately complete the It 2663 2012 Form online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Review the form's purpose and requirements to understand your obligations and exemptions based on real property sales or transfers.

- In Item A, indicate whether the transferor/seller is an individual, estate, or trust by marking the corresponding box.

- In Item B, if applicable, report if the sale is an installment sale for federal income tax purposes by marking the Yes box and specifying the duration of the installment agreement.

- In Item C, mark the box if only a portion of the real property qualifies as your principal residence.

- Complete Part 1 by entering the full name, SSN, and address of the transferor/seller and, if applicable, the spouse or fiduciary.

- Enter a description of the property, including the address and date of the conveyance.

- Proceed to Part 2, where you will use the Worksheet for Part 2 to calculate the sale price and total gain, then enter these amounts.

- In Part 3, certify if you're exempt from the estimated tax payment due to specific conditions by marking the appropriate box and providing brief details.

- Sign the form in Part 4, ensuring both spouses sign if married and using an authorized agent when applicable.

- After reviewing for accuracy, save your changes, and submit the completed form with the payment to the recording officer at the time of the deed's presentation.

Start completing your It 2663 2012 Form online today for a seamless filing experience.

You can access the 1040 form on the IRS website, where it is available for download. In addition, many tax preparation software programs feature the 1040 form, making it easy to complete your tax return. Remember, the 1040 form is essential for filing your tax return, so make sure to have the most updated version. If you're looking to understand how it relates to specific forms, such as the IT 2663 2012 Form, be sure to check additional resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.