Loading

Get Ar1002 Fiduciary Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR1002 Fiduciary Tax online

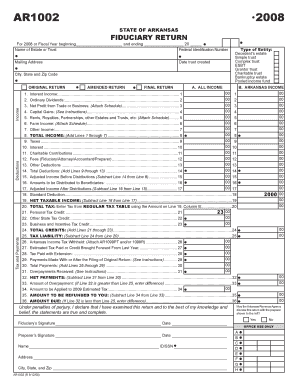

The AR1002 Fiduciary Tax form is essential for reporting the income and deductions of estates and trusts. This guide provides a comprehensive walkthrough to help users navigate the form step-by-step, ensuring accurate completion and filing.

Follow the steps to fill out the AR1002 Fiduciary Tax.

- Click ‘Get Form’ button to obtain the form and open it in your selected editor.

- Enter the federal identification number of the estate or trust on the respective line. It is crucial for identifying the tax entity accurately.

- Provide the name of the estate or trust clearly as it appears in official documents.

- Fill out the mailing address, including city, state, and zip code, to ensure any correspondence from the taxation authority is received.

- Indicate the date the trust was created. This information helps establish the tax year for reporting.

- Select the type of entity by checking the appropriate box, choosing from options like decedent’s estate, simple trust, or charitable trust.

- Report all income in Section A, including interest income and dividends. Be sure to attach any necessary schedules for income sources that require additional documentation.

- Calculate total deductions in Section B. Include taxes, contributions, and other expenses, adding it all together to derive the total deduction amount.

- Compute the adjusted income and amounts to be distributed to beneficiaries in the following fields. It's important to do the math correctly to ensure accurate reporting.

- After completing the form, review all entries for accuracy. Users can save changes, download the completed form, print it, or share it as needed.

Ensure you complete your AR1002 Fiduciary Tax form online accurately for timely filing.

You should file tax form 1041 with the IRS, either electronically or by mail. The specific mailing address depends on your location and whether you are enclosing a payment. Ensure you comply with AR1002 Fiduciary Tax requirements when preparing your return. For additional help, uslegalforms can assist you in finding the correct filing address.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.