Loading

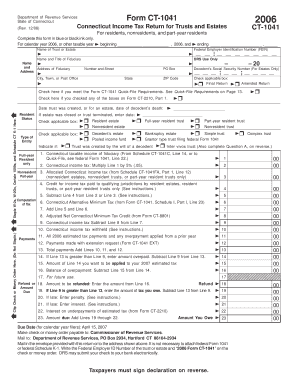

Get Ct 1041 2006 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 1041 2006 Form online

Completing the Ct 1041 2006 Form is an essential step for trusts and estates to report income for the tax year. This guide provides clear instructions to help users navigate the form accurately and efficiently.

Follow the steps to fill out the Ct 1041 2006 Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the general information section at the top of the form, which includes entering the name of the trust or estate, the name and title of the fiduciary, and the Federal Employer Identification Number (FEIN). Ensure that you use blue or black ink only.

- Complete the computation of tax by first determining the Connecticut taxable income of the fiduciary. Enter this amount on Line 1, then follow the instructions to calculate Lines 2 through 9 to arrive at the Connecticut income tax owed.

- Address any questions related to the trust or estate. If you checked ‘Part-year resident trust,’ enter the date it became irrevocable. Respond to questions regarding real property in Connecticut.

- Finally, review the declaration section. A fiduciary representative must sign and date the form, providing their contact information. If a paid preparer assisted in this process, their details must be included as well.

- Once all sections are completed and verified for accuracy, save the changes. You can download, print, or share the completed form, ensuring to keep a copy for your records.

Begin completing your documents online today for a smoother filing experience.

Filling out a 1041 tax form requires careful attention to detail, especially on the CT 1041 2006 Form. Begin with basic information about the estate or trust, followed by specific income types and allowable deductions. Each section must be filled out accurately to reflect the financial activities of the estate or trust. If needed, use platforms like UsLegalForms to provide guidance and templates to ensure a thorough completion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.