Loading

Get Sample 1099 Expense Invoice Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample 1099 Expense Invoice Form online

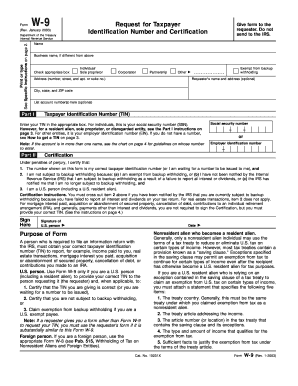

Filling out the Sample 1099 Expense Invoice Form online can streamline your record-keeping and ensure accurate financial reporting. This guide provides simple, step-by-step instructions tailored to help users of all experience levels complete the form effectively.

Follow the steps to complete the Sample 1099 Expense Invoice Form online.

- Click 'Get Form' button to obtain the Sample 1099 Expense Invoice Form and open it in an online editor.

- Fill in the invoice number in the designated field to uniquely identify the invoice.

- Enter the customer’s name, address, city, and phone number in the corresponding sections to provide the necessary billing information.

- In the description section, specify the nature of services or products provided, accompanied by the date of service.

- Record the hours worked and rates in the appropriate fields to calculate the total payment due.

- Fill in the total amount due at the end of the invoice to summarize the total payment being requested.

- Include the name and address of the payee along with the Tax ID number in the designated fields for proper reporting.

- Review all the entered information for accuracy before finalizing the invoice.

- Once you have completed the form, save changes, and choose to download, print, or share the invoice as needed.

Start completing your documents online for efficient and accurate financial management!

Yes, QuickBooks offers several invoice templates that can help streamline your billing process. You can customize these templates to fit your business needs while including essential information. Using a Sample 1099 Expense Invoice Form within QuickBooks can enhance your efficiency and ensure accuracy in your invoicing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.