Loading

Get Ct Reg 8 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Reg 8 Form online

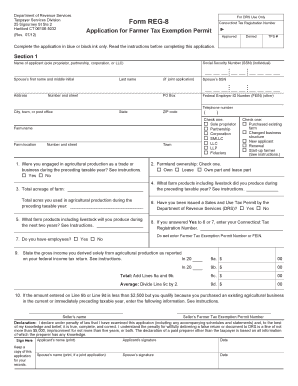

The Ct Reg 8 Form is utilized for applying for a Farmer Tax Exemption Permit in Connecticut. Filling out this form accurately can ensure that you receive the tax benefits associated with agricultural production.

Follow the steps to fill out the Ct Reg 8 Form online easily.

- Press the ‘Get Form’ button to access the Ct Reg 8 Form and open it for editing.

- Begin with Section 1, where you will need to provide your Social Security Number, name, address, and business structure. Ensure you select the appropriate option for your role (sole proprietor, partnership, etc.) and enter your Federal Employer ID Number if applicable.

- In Section 1, enter the total acreage of your farm and the farm products you plan to produce for the next two years.

- Indicate if you had employees in the previous year by checking 'Yes' or 'No' and provide your contact information.

- Complete any additional sections that apply to your situation, such as disclosing your farm income reported on the federal tax return or any relevant details about purchased products.

- Carefully review the declaration statement at the end of the form, ensuring all provided information is truthful and accurate.

- Once all sections are completed and reviewed, save your changes. You can then proceed to download, print, or share your completed Ct Reg 8 Form as necessary.

Start filling out your Ct Reg 8 Form online today to take advantage of the benefits!

A $12000 property tax exemption typically refers to a reduction in the taxable value of your property, which can lead to lower taxes owed. This exemption may apply based on various factors like age or income levels. To navigate this process effectively, utilize the Ct Reg 8 Form to ensure you apply correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.