Loading

Get Beneficiary Deed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Beneficiary Deed online

Filling out a Beneficiary Deed online is an essential process for individuals looking to designate beneficiaries for their property. This guide provides clear, step-by-step instructions to help users complete the document accurately and efficiently.

Follow the steps to fill out the Beneficiary Deed online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- In the first section, enter the name of the individual who is revoking the previous beneficiary deed. This should be filled in clearly to indicate the grantor's identity.

- Next, provide the mailing address, including the city, state, and zip code. Make sure this information is accurate to ensure proper correspondence.

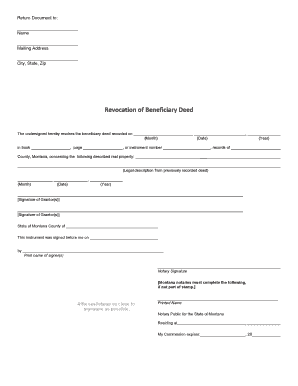

- Locate the section labeled 'Revocation of Beneficiary Deed.' Here, specify the date of the previous beneficiary deed recorded, along with the details of the book and page number or instrument number related to the document being revoked.

- Describe the real property as stated in the previous deed. It is essential to use the legal description exactly as it appears to prevent any legal issues.

- The grantor must sign the document in the designated spaces. If there are multiple grantors, ensure that all signatures are included to validate the revocation.

- After signing, the document will need to be notarized. Fill in the required fields, including the notary's name, signature, and the address or jurisdiction of the notary public.

- Finally, review all entered information for accuracy before saving your changes. You can then download, print, or share the completed Beneficiary Deed as needed.

Complete your Beneficiary Deed online today and ensure your property is managed as per your wishes.

When filling in beneficiary details, include their full name, contact information, and relationship to you. Be clear about their role to prevent any confusion after your passing. Remember, the more precise you are in naming them in a Beneficiary Deed, the smoother the transfer process will be for your chosen beneficiary. You can find templates and examples at US Legal Forms to assist with this.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.