Loading

Get Mo1040 2008 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo1040 2008 Form online

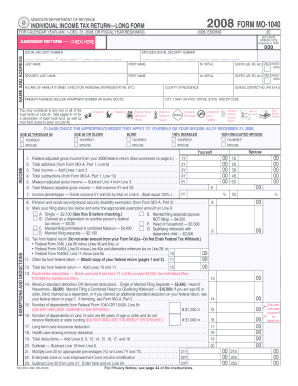

Filling out the Mo1040 2008 Form online can facilitate your tax filing process, ensuring accuracy and efficiency. This guide provides a step-by-step approach to help users navigate each section of the form with clarity.

Follow the steps to complete your Mo1040 2008 Form online.

- Click ‘Get Form’ button to access the Mo1040 2008 Form in your preferred editor.

- Begin by entering your personal information, including your name, address, and social security number. Be sure to include your spouse's information if applicable.

- Indicate whether this is an amended return by checking the appropriate box as per your filing situation.

- Provide your federal adjusted gross income from your 2008 federal return calculated from the worksheet indicated in the form.

- Fill out the total additions and subtractions as indicated, which may involve referring back to Form MO-A for accuracy.

- Calculate your Missouri adjusted gross income by subtracting any subtractions from your total income.

- Complete the exemptions and deductions section by marking your filing status and entering the appropriate exemption amounts.

- Calculate your total tax using the provided lines and ensure the accuracy of all entries related to tax deductions.

- Fill out the payments and credits section, which includes entering the state tax withheld and any estimated tax payments made.

- Review all entered information for accuracy before saving or downloading the form. Once confirmed, you can print or share the completed form as needed.

Take action today by completing your Mo1040 2008 Form online and ensure timely filing.

The easiest way to file the Mo1040 2008 Form is to use an online tax preparation platform. These services guide you through each step, making the process efficient and straightforward. They also help minimize the potential for errors by offering tips and validation checks. Engaging with a service like uslegalforms can enhance your experience greatly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.