Loading

Get Form 8804 - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8804 - IRS online

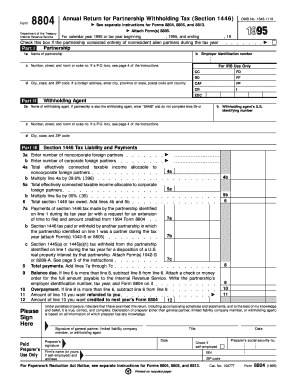

Filling out Form 8804 is essential for partnerships that have withholding tax obligations under Section 1446. This guide will provide step-by-step instructions on how to complete the form effectively and accurately online.

Follow the steps to complete your Form 8804 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the partnership in Part I, Section 1a. Ensure that you also provide the employer identification number in Section 1b and the complete address, including city, state, and ZIP code in Sections 1c and 1d.

- Proceed to Part II, Section 2a to enter the name of the withholding agent. If the partnership itself acts as the withholding agent, write 'SAME' in Section 2a and leave Sections 2b to 2d blank.

- In Part III, Section 3, specify the number of noncorporate foreign partners in Section 3a and the number of corporate foreign partners in Section 3b.

- For Section 4, calculate the total effectively connected taxable income allocable to noncorporate foreign partners and enter it in Section 4a. Then, multiply this amount by 39.6% and enter the result in Section 4b.

- In Section 5, input the total effectively connected taxable income allocable to corporate foreign partners in Section 5a. Similarly, multiply this amount by 35% and note it in Section 5b.

- Add the amounts from Sections 4b and 5b to calculate the total Section 1446 tax owed, and input this figure in Section 6.

- Detail any payments of Section 1446 tax made by the partnership during the tax year in Section 7a, and any amounts credited from Form 8804 of the prior year.

- Input payments made or withheld by other partnerships in Section 7b, ensuring to attach relevant forms as necessary.

- If applicable, enter any Section 1445 tax withheld in Section 7c, attaching Forms 1042-S or 8288-A as needed.

- Calculate the total payments in Section 8 by adding Sections 7a through 7c.

- If the tax owed in Section 6 exceeds the total payments in Section 8, subtract to find the balance due. Attach a check or money order for the balance payable to the IRS.

- If total payments exceed the tax owed, calculate the overpayment in Section 10 and decide on the refund or credit options in Sections 11 and 12.

- Sign and date the form where indicated, ensuring that the preparer's details are completed if applicable.

- Once all sections are filled out accurately, save your changes and then download, print, or share the completed Form 8804 as needed.

Complete your Form 8804 online today to ensure compliance with IRS requirements.

Related links form

Whether you need to file Form 8804 - IRS depends on your status as a partnership. If your partnership has U.S. income that is subject to withholding, filing the form is mandatory. It’s a good practice to assess your partnership’s tax obligations diligently to ensure compliance. Tools like those provided by US Legal Forms can assist you in determining your filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.