Loading

Get It216 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It216 Instructions online

Filling out the It216 Instructions can seem daunting, but with this guide, you will find it straightforward and manageable. This comprehensive resource provides step-by-step instructions tailored to your needs, ensuring you can successfully complete your child and dependent care credit claim.

Follow the steps to fill out the It216 Instructions with ease.

- Click ‘Get Form’ button to obtain the It216 Instructions and open it in your document editor.

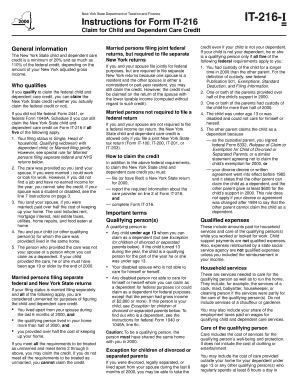

- Review the general information section carefully. Ensure that you understand who qualifies for the child and dependent care credit before proceeding.

- Complete your personal information at the top of the form, including your name and address. Ensure all entries are made neatly within the specified boxes.

- In the section for care provider information, enter the care provider’s name, address, and their social security number or employer identification number as applicable.

- Detail the amount you paid to the care provider during the tax year in the appropriate section, ensuring to keep accurate records.

- List the names and social security numbers of all qualifying persons for whom you are claiming the credit, along with their birth years.

- Calculate and enter your qualified expenses on line 5, as instructed based on your federal filings.

- Complete the following lines by entering your federal adjusted gross income and any other necessary information as outlined in the form's instructions.

- After reviewing all entries for accuracy, save the changes made to your form. Download or print your completed It216 Instructions to retain a copy for your records.

- If required, share your completed document as necessary based on your filing situation.

Start filling out your It216 Instructions online today for a smooth filing experience.

Related links form

To fill out your tax withholding correctly, begin by assessing your income and expenses carefully. Use the IRS guidelines to determine your filing status and allowances. Reference the It216 Instructions for a comprehensive walkthrough that can help optimize your withholdings for your personal tax situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.