Loading

Get 502inj Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 502inj form online

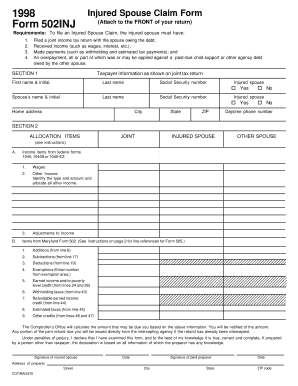

Filling out the 502inj form, also known as the Injured Spouse Claim Form, is an important step for individuals seeking relief from the interception of tax refunds. This guide provides a clear walkthrough to assist users in completing the form online with ease and accuracy.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the form and load it in the online editor.

- In Section 1, input taxpayer information as it appears on the joint tax return. Include first name, last name, Social Security number, and indicate whether you are the injured spouse by selecting 'Yes' or 'No'. Ensure to fill in the spouse's details as well.

- Provide your home address, including city, state, and ZIP code. Additionally, enter your daytime phone number for contact purposes.

- Move to Section 2, which covers allocation items. For each income item listed from your joint federal forms, allocate the amounts between the injured spouse and the other spouse, ensuring to follow the specific instructions for wages and other income.

- For the Maryland specific items, transfer the necessary amounts from your Maryland return. Allocate additions, subtractions, deductions, exemptions, and credits according to the instructions provided to ensure accuracy.

- After completing all sections, review your entries for completeness and accuracy. Once verified, proceed to sign the form as the injured spouse and include the date of your signature.

- If a paid preparer completed the form, they should also sign and date it, providing their address.

- Finally, attach the completed 502inj form to the front of your tax return. Write “INJURED SPOUSE” in the upper left corner of your return before submitting.

- Save your changes, then download or print the completed form for your records and share it as needed.

Start filling out your forms online now to ensure a smooth filing process.

To fill out your Income Tax Return (ITR), start by gathering all relevant financial documents, including income statements and deduction records. Next, choose the correct form based on your filing needs, and carefully input your information. Us Legal Forms offers resources, including the 502inj Form, to guide you through each step, ensuring you complete your ITR accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.