Get Form Last Revised June, 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Last Revised June, 2011 online

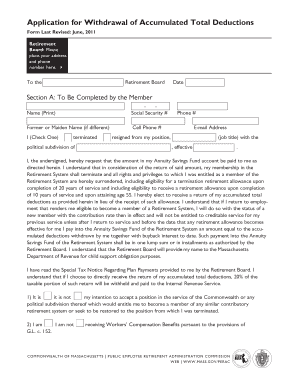

This guide provides clear and detailed instructions on how to fill out the Application for Withdrawal of Accumulated Total Deductions form, which allows eligible members to request a refund from their annuity savings account. Follow the steps carefully to ensure your submission is accurate and complete.

Follow the steps to complete the form accurately

- Press the ‘Get Form’ button to access the Application for Withdrawal of Accumulated Total Deductions form and open it in your preferred online editor.

- Begin with Section A, where you will enter your full name, Social Security number, and any former or maiden name if applicable. Provide your cell phone number and email address to ensure the board can contact you if necessary.

- Indicate your employment status by checking the appropriate option stating whether you have terminated or resigned from your position. Fill in your job title and the date this became effective.

- In Section A, further acknowledge your request for withdrawal and understand the implications of terminating your membership in the retirement system by reading through the statements provided. Make sure to check the applicable boxes regarding your intention to seek reemployment or receipt of Workers’ Compensation.

- Select your method of payment in the designated area. Review the options carefully and check the box that aligns with how you wish to receive your funds. If applicable, provide the necessary account information for direct transfers.

- Sign and date the Member's Signature block at the bottom of page 3, ensuring that a witness also signs and provides their printed name and date.

- After completing all required fields and signatures, review your form for completeness. Save your changes, and you may choose to download, print, or share the form as necessary to submit it.

Start filling out your Application for Withdrawal of Accumulated Total Deductions form online today!

Schedule 8812 is used to claim the Additional Child Tax Credit, allowing you to receive a refund even if you do not owe taxes. This form is especially important for families looking to maximize their tax benefits. To ensure you're using the correct version, refer to IRS Form Last Revised June, 2011, which outlines the necessary guidelines and instructions. If you feel uncertain about completing it, US Legal Forms has tools and templates to help you accurately fill out your tax forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.