Get Tax Refund Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Refund Application Form online

Filling out the Tax Refund Application Form online can seem daunting, but with clear guidance, it can be a straightforward process. This guide provides step-by-step instructions to help you successfully complete the form and submit your tax refund application.

Follow the steps to complete your application with confidence.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

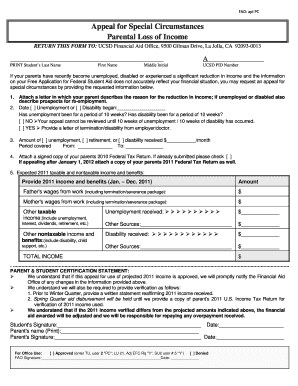

- Fill in the student's last name, first name, and middle initial in the corresponding fields to accurately identify the applicant.

- Enter the UCSD PID number in the designated area to link the application to the correct student profile.

- Attach a letter from your parent explaining the reason for the loss of income or other financial challenges, including their prospects for re-employment if applicable.

- Specify the date when the unemployment or disability began, and indicate if this has lasted for a period of at least ten weeks by checking the appropriate box.

- Detail the amount of any unemployment, retirement, or disability benefits received on a monthly basis and include the period covered.

- Attach a signed copy of your parent's 2010 Federal Tax Return; if appealing after January 1, 2012, include the 2011 Federal Tax Return as well.

- Fill in the expected taxable and nontaxable income for the year 2011, providing specific amounts for wages, unemployment, disability, and other sources.

- Complete the certification statement confirming understanding of the requirement to report any changes in information provided and sign it where indicated.

- Save changes, download, print, or share the completed form according to your preferences for submission.

Start your application process online today to ensure a smooth and timely submission.

Determining the best filing status for the biggest refund can be important for your tax strategy. Generally, married couples filing jointly may benefit from more deductions and credits compared to other statuses. However, every situation is unique, so it is wise to assess your own financial circumstances. A Tax Refund Application Form can assist you in identifying the most advantageous filing status for your specific situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.