Loading

Get G 495c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G 495c form online

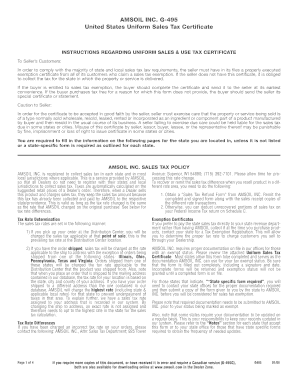

Filling out the G 495c form can seem daunting, but with this step-by-step guide, users will find the process straightforward and manageable. This comprehensive instruction aims to assist individuals in completing the form accurately and efficiently.

Follow the steps to complete the G 495c form with ease.

- Click the ‘Get Form’ button to access the G 495c form and open it in your preferred editor.

- Fill in the issuer's information, including the name of the seller, their address, and contact details. It is essential to provide accurate information to ensure proper processing.

- In the certification section, include the name of the buyer's firm, any doing-business-as (DBA) names, and a complete address for the firm. This information is crucial for confirming the identity of the buyer.

- Select the appropriate category of engagement by checking all relevant boxes, such as wholesaler, retailer, manufacturer, or lessor. This designation helps clarify the nature of the buyer’s business.

- Provide a detailed description of the business operations, ensuring clarity and completeness. This information supports the claim for tax-exempt status.

- List the general description of tangible property or taxable services intended to be purchased from the seller. Be precise in this description to avoid any misunderstandings.

- Complete the state registration sections by entering the seller's permit, identification number, or other relevant state-specific details as required.

- Review the entire form for accuracy and completeness. Ensuring that every field is filled out correctly can prevent delays or issues with tax exemption status.

- Sign and date the form in the designated area at the bottom. An authorized signature is crucial for the validity of the exemption certificate.

- Once all information is complete and accurate, save your changes. You can then download, print, or share the form as required.

Ready to proceed? Complete your G 495c form online today!

Related links form

If you fail to include your 1095-C when filing, it may lead to discrepancies in your tax return. Without the G 495c Form, the IRS may question your health coverage status, possibly affecting your refund. It's best to report all required forms accurately to avoid complications. You can use platforms like uslegalforms to ensure you have all necessary documentation for a smooth tax filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.