Get Maryland Form El102

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maryland Form EL102 online

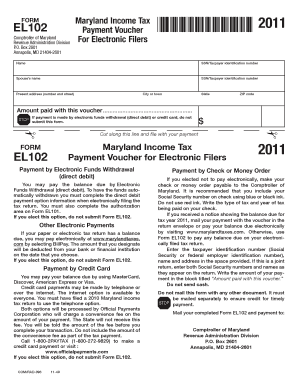

Filling out the Maryland Form EL102 is an important step for individuals who need to submit a payment voucher with their electronically filed income tax return. This guide will provide you with step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Maryland Form EL102 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and taxpayer identification number in the designated fields. If you are filing jointly, include your partner's name and their taxpayer identification number as well.

- Fill in your present address, including the number and street, city or town, state, and ZIP code in the appropriate sections.

- In the section titled 'Amount paid with this voucher', enter the amount you wish to pay. Make sure this figure reflects the balance due from your electronically filed return.

- If you are planning to pay by check or money order, make your payment payable to the Comptroller of Maryland. It is advisable to write your Social Security number on the payment and include the tax type and the year.

- Review your form for any errors or missing information. Ensure that all required fields are completed correctly before proceeding.

- After completing the form, you can save your changes, download the form for your records, print it for mailing, or share it as needed.

Complete your Maryland Form EL102 online today to ensure timely processing of your tax payment.

Generally, you are not required to include a copy of your federal return with your Maryland state return. However, if you are using specific forms like Maryland Form El102, it may be helpful to have your federal return handy for reference. Always double-check the instructions for any specific requirements related to your situation. Platforms such as UsLegalForms can provide resources to ensure your compliance with state and federal tax regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.