Get Form 74 026 001 01

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 74 026 001 01 online

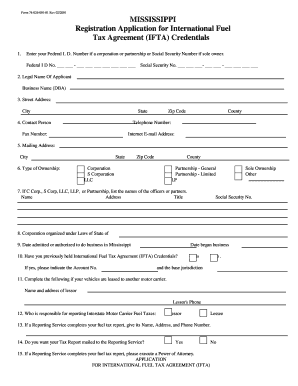

Filling out the Form 74 026 001 01, the registration application for International Fuel Tax Agreement credentials, is an essential process for businesses engaged in interstate fuel transportation. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring you accurately provide all necessary information.

Follow the steps to properly complete Form 74 026 001 01 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Enter your Federal I.D. Number or Social Security Number in the designated fields. Ensure accuracy to avoid processing delays.

- Provide the legal name of the applicant and the business name (doing business as), if applicable.

- Fill in your street address, city, state, and zip code. Ensure the details are current and correctly formatted.

- Indicate the contact person's name, telephone number, fax number, email address, and county to facilitate communication.

- Complete the mailing address fields, including city, state, zip code, and county if different from the street address.

- Choose the type of ownership from the provided options (e.g., corporation, partnership). This will determine the subsequent requirements.

- If applicable, list the names, addresses, and titles of officers or partners involved in the business along with their Social Security Numbers.

- Indicate the state under which the corporation is organized and provide the date you were authorized to do business in Mississippi.

- Specify whether you have previously held IFTA credentials and provide the account number and base jurisdiction if yes.

- If your vehicles are leased, include the name and address of the lessor along with their phone number.

- Identify who is responsible for reporting interstate motor carrier fuel taxes.

- If a reporting service handles your tax reports, provide their name, address, and phone number.

- Indicate if you want your tax report mailed to the reporting service.

- If a reporting service completes your tax report, ensure a Power of Attorney is executed.

- Fill in the IRP account number and base state, and provide information on any vehicles based outside Mississippi.

- Enter your U.S. DOT number and indicate the type of fuel your vehicles use.

- Complete the schedule by marking the jurisdictions where you operate qualified motor vehicles or have fuel storage.

- Indicate the number of motor vehicles requiring IFTA decals.

- Review all information for accuracy, and then save changes. You can choose to download, print, or share the completed form.

Begin filling out your Form 74 026 001 01 online today to ensure compliance with IFTA requirements!

Related links form

Florida does not have a state income tax, so there isn't a state withholding form required for income tax purposes. However, employers must still manage payroll taxes, and they might require specific forms for federal purposes. For clarity on these requirements and help with Form 74 026 001 01, uslegalforms can be a helpful resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.