Loading

Get 3519 Pit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3519 Pit online

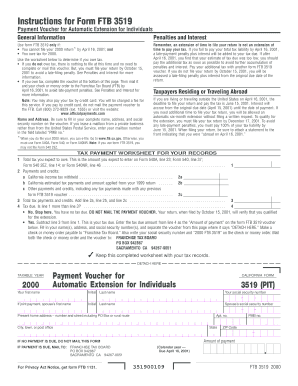

The 3519 Pit, or Payment Voucher for Automatic Extension for Individuals, is essential for taxpayers who cannot file their return by the due date. This guide will provide clear and thorough instructions on how to successfully complete the form online.

Follow the steps to fill out the 3519 Pit online.

- Click ‘Get Form’ button to access the 3519 Pit online form.

- Fill in your complete name, address, and social security number in the designated fields on the voucher. Ensure that your address is accurate to avoid any issues with mailing.

- If applicable, enter your spouse's first name, initial, last name, and social security number for joint payment. Be sure to double-check the accuracy of this information.

- Complete the 'Amount of payment' field with the total tax amount due. Refer to your Tax Payment Worksheet to calculate this amount accurately.

- Should there be no tax due, note that you do not need to mail the payment voucher. Ensure your return is filed by October 15 to avoid penalties.

- If payment is due, detach the voucher from the form. Make your check or money order payable to 'Franchise Tax Board,' writing your social security number and '2000 FTB 3519' on it.

- Mail both the completed voucher and payment to the Franchise Tax Board at the provided address to avoid late payment penalties.

- Once you have completed the form, save your changes. You can also download, print, or share the form for your records.

Complete your documents online today to ensure timely submission.

G form reports unemployment benefits or state tax refunds you received during the year and can impact your tax liability. If you receive a refund, it may be taxable depending on your situation. Review the information on the 1099G carefully to determine its effect on your taxes. For detailed assistance, consider using US Legal Forms to navigate your specific circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.