Loading

Get Ms Form 70 698

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Ms Form 70 698 online

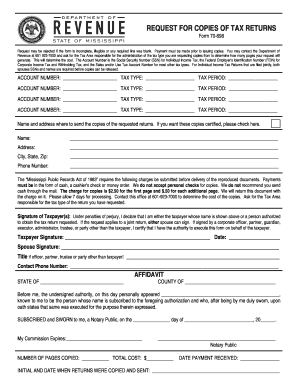

Filling out the Ms Form 70 698 is an essential step in requesting copies of your tax returns. This guide will provide you with detailed, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Ms Form 70 698 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, fill in the account number related to your tax type, such as your Social Security Number for Individual Income Tax, Federal Employer’s Identification Number for Corporate Income Tax, or the appropriate tax account number for Sales and/or Use Tax.

- Next, specify the tax type and tax period for each account number you have provided. Ensure that no fields are left blank to avoid rejection of your request.

- Provide the name and address where the copies should be sent. If you require certified copies, make sure to indicate this clearly by checking the appropriate option.

- Fill in your contact phone number and any additional necessary information requested on the form, ensuring clarity and legibility.

- At the bottom of the form, the taxpayer(s) need to sign and date the request. If applicable, the spouse’s signature is also required.

- For submissions made by someone other than the taxpayer, include the title and authority of the signer.

- Lastly, review the form carefully to ensure all necessary information is completed. Save your changes before submitting. You may download, print, or share the form as needed.

Complete your document requests online confidently and efficiently.

Yes, the T1198 form is mandatory for those who have transactions that require it, especially related to capital gains. Failing to file it when necessary can result in penalties. If your financial activities resemble those handled by the Ms Form 70 698, it's wise to ensure all required forms are submitted to avoid issues down the line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.