Get Tsp 1 C Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tsp 1 C Fillable Form online

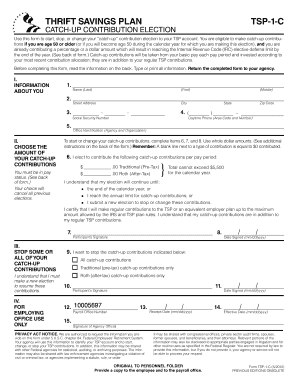

The Tsp 1 C Fillable Form is essential for individuals 50 years and older who wish to start, stop, or modify their catch-up contributions to their Thrift Savings Plan (TSP) account. This guide will provide clear, step-by-step instructions on how to effectively complete this form online.

Follow the steps to fill out the Tsp 1 C Fillable Form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information in Section I, including your name, street address, city, state, zip code, social security number, and daytime phone number. Ensure that all fields are filled accurately.

- In Section II, select your catch-up contribution amounts. You can choose to contribute to both Traditional (Pre-Tax) and Roth (After-Tax) contributions. Enter a whole dollar amount for each contribution type. Note that a blank line indicates $0 contributed.

- Indicate the conditions under which your catch-up contributions will stop by marking the appropriate box. This could be at the end of the calendar year, upon reaching the annual limit for contributions, or if you submit a new election.

- Sign and date the form in the designated areas to certify your catch-up contribution election.

- If you wish to stop some or all of your catch-up contributions, complete Section III. Select whether you want to stop all contributions or just one type and provide your signature.

- Review the form to ensure all information is completed accurately. Once satisfied, save your changes, and download or print the form for submission to your agency.

Complete your Tsp 1 C Fillable Form online today to ensure your catch-up contributions are properly managed.

Related links form

You should send your TSP 1 form, which is used for contributions or changes to your account, to the TSP Service Office. Their address is typically provided on the form itself or the official TSP website. Ensure that you keep a copy for your records. For convenience, using the Tsp 1 C Fillable Form available on UsLegalForms ensures you have the proper format and instructions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.