Loading

Get Eic Interview Sheet Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eic Interview Sheet Tax Form online

Filling out the Eic Interview Sheet Tax Form online can seem daunting, but with this guide, you will be equipped with the knowledge to complete it efficiently. This comprehensive step-by-step process aims to simplify the necessary fields and ensure that you provide accurate information for your tax filing.

Follow the steps to complete the Eic Interview Sheet Tax Form online.

- Press the ‘Get Form’ button to access the Eic Interview Sheet Tax Form and open it in your document editor.

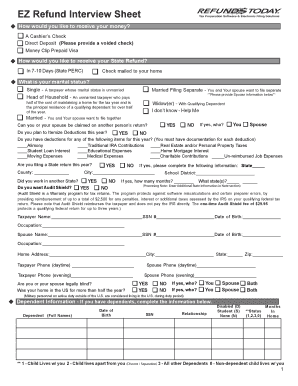

- Begin by indicating how you would like to receive your money: select from options such as a cashier’s check, direct deposit (and provide a voided check), or a prepaid Visa card.

- Next, specify your preferred method for receiving your state refund, choosing either a quicker processing option or a check mailed to your home.

- Indicate your marital status by selecting the appropriate option and providing necessary spouse information if applicable.

- Answer whether you or your spouse can be claimed on someone else's return and if you plan to itemize deductions this year.

- List any deductions you intend to claim, ensuring you have documentation for each item, such as alimony, student loan interest, and medical expenses.

- State whether you are filing a state return and provide relevant state and city information.

- Indicate if you worked in another state and, if so, provide details regarding duration and state.

- Decide if you want to add Audit Shield to protect against potential IRS issues, and understand the associated fees.

- Fill out your personal information including name, SSN, date of birth, and occupation, and repeat for your spouse if applicable.

- If applicable, complete the Dependent Information section with details for each dependent.

- Finish by entering your PIN for e-filing authorization and signing the document to certify that all provided information is accurate.

- Finally, save changes, download, print, or share the completed Eic Interview Sheet Tax Form as needed.

Complete your Eic Interview Sheet Tax Form online today!

Related links form

Common EITC mistakes include incorrect Social Security numbers, mismatched income claims, and failing to include all qualified children. Make sure you have the right EIC Interview Sheet Tax Form handy to guide you through the process. Additionally, double-check your entries to avoid discrepancies that could delay your refund. By staying vigilant, you can avoid these pitfalls.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.