Get Ally Roth Ira - Transfer Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ally Roth IRA - Transfer Request online

Filling out the Ally Roth IRA - Transfer Request form online can seem daunting, but with the right guidance, you can complete it efficiently. This guide provides clear instructions for each section of the form, ensuring a smooth transfer process.

Follow the steps to complete your transfer request accurately.

- Press the ‘Get Form’ button to access the Ally Roth IRA - Transfer Request form and open it in your preferred editor.

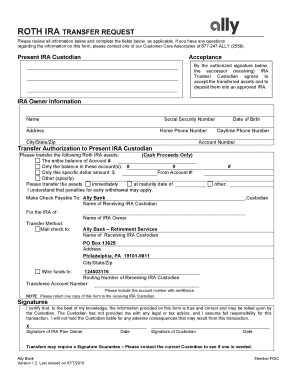

- Fill in your personal details in the 'IRA Owner Information' section. This includes your name, Social Security number, address, home phone number, city/state/zip code, date of birth, daytime phone number, and your account number.

- In the 'Transfer Authorization to Present IRA Custodian' section, specify the assets you wish to transfer. You can choose to transfer the entire balance, only specific amounts, or certain accounts. Ensure you indicate your preference clearly.

- Indicate the transfer method by filling in the postal address for mailing or specifying the wire transfer details, including the routing number and transferee account number.

- Review the 'Acceptance' section, making sure you are aware that the receiving IRA trustee/custodian agrees to accept the transferred assets when you provide your authorized signature.

- Read and acknowledge the certification statement, indicating that the information provided is accurate. You will need to provide your signature and the date of signature in this section.

- If required, contact your current custodian to determine whether a signature guarantee is necessary for this transfer.

- Once you have completed the form, save your changes. You may then choose to download it for your records, print a copy, or share it as required.

Complete your Ally Roth IRA - Transfer Request online today to ensure a seamless transfer of your assets.

Transferring a Roth IRA from one institution to another involves a few straightforward steps. First, contact your new financial institution and inquire about their Ally Roth IRA - Transfer Request process. You will typically need to fill out a transfer form to initiate the move, allowing the new institution to contact your old one directly. This ensures that the transfer is completed securely and in compliance with IRS rules.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.