Loading

Get Form 8836

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8836 online

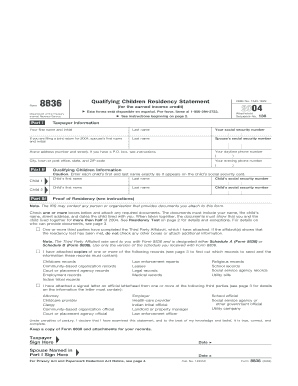

Filling out Form 8836 is a crucial step in claiming the earned income credit for those with a qualifying child. This guide provides you with a clear and supportive framework to complete the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete Form 8836 online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- In Part I, enter your personal information, including your first name, last name, social security number, and contact details. If applicable, provide your spouse's information as well.

- Proceed to Part II and list each qualifying child's first and last name as shown on their social security card, along with their respective social security numbers.

- In Part III, select one or more residency proof options that validate the child's residency with you for more than half of the year. Attach the required documents as specified.

- Once all fields are complete and documents attached, proceed to review all information for accuracy. Be sure to sign and date the form under penalties of perjury.

Complete your Form 8836 online today to ensure your earned income credit claim is processed smoothly.

Related links form

To file Form 8863, you typically need your tax return from the previous year, the education institution's Form 1098-T, and any receipts for qualified expenses. Additionally, if you're claiming credits related to purchasing a clean vehicle, having Form 8836 handy can streamline your documentation process. It's best to gather all essential documents before filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.