Get Lake County Tangible Personal Property Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lake County Tangible Personal Property Tax Return online

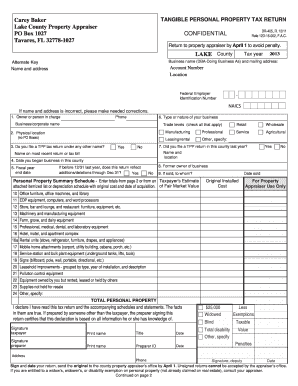

Filing the Lake County Tangible Personal Property Tax Return is an essential step for people holding tangible personal property for commercial purposes. This guide provides a clear and detailed process to assist users in completing the form accurately and effectively online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your selected method.

- Enter your business name and mailing address at the top of the form. Ensure that all details are accurate and up-to-date.

- Provide contact information, including the name and phone number of the person in charge. This helps for any inquiries regarding your return.

- Fill in the physical location of your business, avoiding PO Boxes.

- Indicate whether you are filing the Tangible Personal Property tax return under any other name and provide the name from the most recent return, if applicable.

- Specify the date you began your business in the county and the fiscal year end date. This information is crucial for tax records.

- List all items of tangible personal property owned, including descriptions, years acquired, and original installed costs. Group items by category for clarity.

- Report your taxpayer estimate of fair market value for each asset in the designated columns. Be honest and accurate to avoid penalties.

- Complete the section for assets physically removed during the last year, indicating any sales or disposals.

- Sign and date the return to validate it. Remember that unsigned returns will not be accepted.

- Review your form for accuracy and completeness, then save your changes. You may download, print, or share the form as needed.

Complete your Lake County Tangible Personal Property Tax Return online today to ensure compliance and avoid any late penalties.

Yes, in Florida, you are generally required to file a tangible property tax return if you own tangible personal property used for business purposes. This filing helps local authorities assess the value of items such as machinery or inventory. For a smoother filing process, consider utilizing services like US Legal Forms to assist you with your Lake County Tangible Personal Property Tax Return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.