Loading

Get Form 100s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 100s online

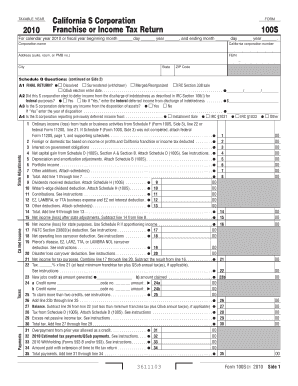

Filling out the Form 100s is an essential process for California S corporations to report their franchise or income taxes. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately online.

Follow the steps to fill out the Form 100s confidently.

- Press the ‘Get Form’ button to acquire the form and open it in your online editor. This will allow you to begin filling out the details.

- Enter the taxable year at the top of the form, specifying whether it is for the calendar year or a fiscal year.

- Provide your corporation's name, California corporation number, address, FEIN, city, state, and ZIP code. Ensure that all information is accurate to avoid issues.

- Answer the questions in Schedule Q. Mark the appropriate box for whether this is a final return, if income has been deferred, and any other relevant inquiries.

- Complete the income section, detailing ordinary income (loss) from your business activities. Ensure you attach any necessary supporting documents, such as federal Form 1120S.

- Fill out deductions applicable to your corporation, including contributions, business expenses, and other relevant data. Carefully follow any instructions provided for calculations.

- Review all entered information for accuracy. Use any provided preview options to ensure all fields are filled satisfactorily.

- Once satisfied with the completeness and accuracy of the form, save your changes. You can then choose to download, print, or share the completed form as needed.

Start completing your Form 100s online today to ensure timely and accurate filing.

Related links form

To fill out a withholding exemption form, begin by entering your personal details such as name and address. Next, provide your reason for claiming the exemption and any required information based on your income level and tax situation. Once you complete the form, submit it to your employer to adjust your withholding. For guidance, US Legal Forms can offer templates and suggestions for accurate completion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.