Get Iracmbdislaz

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iracmbdislaz online

This guide provides comprehensive instructions on completing the Iracmbdislaz form online. Whether you are a seasoned user or new to these forms, this step-by-step approach will help ensure that you fill out the necessary fields accurately and efficiently.

Follow the steps to complete the Iracmbdislaz form online.

- Press the ‘Get Form’ button to receive the Iracmbdislaz form and open it in your preferred online editing tool.

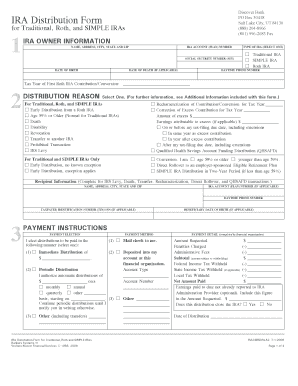

- Begin by filling in your IRA owner information, including your full name, address, city, state, and zip code. Make sure to provide accurate details to prevent any issues with processing.

- Enter your IRA account (plan) number and your Social Security number (SSN). Ensure all information is correct, as errors can lead to delays.

- Include your date of birth and, if applicable, the date of death. This section is essential for ensuring your distribution is handled properly.

- Select the type of IRA from the options available: Traditional IRA, SIMPLE IRA, or Roth IRA. Make sure to choose the correct option that applies to your account.

- Provide your daytime phone number for any follow-up communication regarding your submission.

- If you are submitting for a Roth IRA contribution or conversion, indicate the tax year of the first contribution or conversion.

- Choose the reason for your distribution from the provided list. These options help to clarify the purpose of your withdrawal.

- For distribution reasons that require recipient information, complete the necessary fields including the recipient's name, address, taxpayer identification number, and any other relevant details.

- Select your payment instructions, specifying how you would like to receive your distribution — whether via check mailed to you or direct deposit to your account.

- Fill in the amount requested for your distribution. Be aware that penalties or administrative fees may apply.

- If applicable, indicate your withholding election for federal and state taxes. This ensures that the correct amount is withheld from your distribution.

- Finally, review your information for accuracy and completeness. Once satisfied, proceed to sign the form electronically and provide the date. Ensure a custodian or trustee signature is obtained if necessary.

- After completing all fields, you can choose to save your changes, download the form for your records, print a hard copy, or share the completed form as required.

Complete your documents online with confidence today!

An IRA BDA, or Beneficiary Designated Account, refers to a type of account setup that simplifies the transfer of funds upon the account holder's passing. This ensures that beneficiaries receive their inheritance without unnecessary legal hurdles or delays. By utilizing an IRA BDA, individuals can enhance their estate planning strategy, making it easier for loved ones to access these funds. Thus, understanding IRA BDAs becomes vital in managing your accounts effectively, including under the framework of Iracmbdislaz.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.