Loading

Get Subset Of 1120 Business Rules For Amended Returns 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Subset Of 1120 Business Rules For Amended Returns 2010 Form online

Filling out the Subset Of 1120 Business Rules For Amended Returns 2010 Form online can seem challenging, but with clear guidance, you can navigate through it effectively. This guide provides step-by-step instructions to help you complete the form correctly.

Follow the steps to fill out your form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

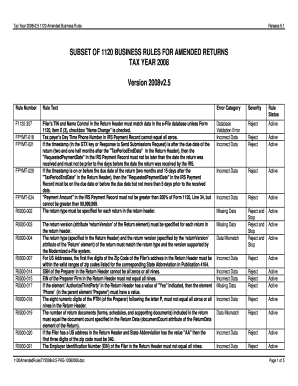

- Start by providing your taxpayer identification number (TIN) and name control in the return header, ensuring this matches the data in the e-File database. If you have changed your name, check the 'Name Change' box.

- Enter your daytime phone number in the IRS payment record; it should not consist of all zeros.

- Specify the return type in the return header accurately. Ensure the return version matches the one supported by the Modernized e-File system.

- For U.S. addresses, verify the first five digits of the zip code are valid for the listed state. Pay attention to specific rules for certain state abbreviations.

- Highlight the tax period's ending date consistently, ensuring it is less than the received date of the return.

- If you select the 'PIN Number' option for signature, ensure all necessary fields are filled out, including practitioner and taxpayer PIN numbers.

- Review your form thoroughly for accuracy, ensuring all required fields are completed and that there are no data mismatches.

- Save your changes, and when ready, download, print, or share the completed form as per your needs.

Complete your documents online today for an efficient filing experience.

Related links form

Yes, you can e-file an amended 1120 return, which makes the process more efficient and timely. The IRS has guidelines that outline the conditions under which e-filing is permitted for amendments. However, check the specific requirements because not all situations allow for e-filing. Utilizing the Subset Of 1120 Business Rules For Amended Returns 2010 Form can provide clarity on this matter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.