Loading

Get W 9 Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 tax form online

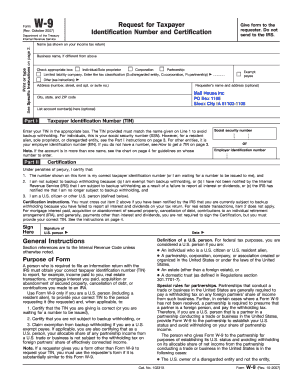

Filling out the W 9 tax form online can seem daunting, but it is a straightforward process when approached step-by-step. This guide provides comprehensive instructions to help you accurately complete the form to meet your tax obligations.

Follow the steps to complete the W 9 tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your name as it appears on your income tax return in the 'Name' field. If your business name differs, include it in the 'Business name' field.

- In Part I, provide your Taxpayer Identification Number (TIN). For individuals, this is your Social Security Number (SSN). For other entities, enter the Employer Identification Number (EIN).

- Review all entries for accuracy before finalizing the form.

Complete your W 9 tax form online today and ensure your tax records are accurate.

No, a W-9 form is not the same as a 1099. The W-9 Tax Form is used to provide your taxpayer identification information to someone who needs it, such as a business or company that pays you. In contrast, a 1099 form is used to report the income you received from that payer. Essentially, the W-9 allows the payer to know who you are, while the 1099 shows how much you earned.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.