Loading

Get Clinton Foundation Irs 990 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Clinton Foundation IRS 990 Form online

This guide provides a comprehensive overview of the steps required to fill out the Clinton Foundation IRS 990 Form online. Designed to be user-friendly, this resource will help individuals and organizations navigate the process with clarity and confidence.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

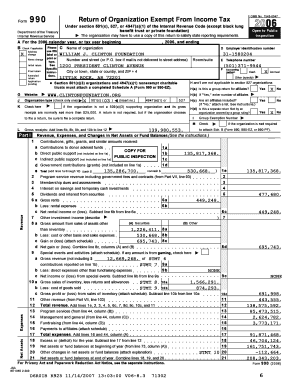

- Provide the organization’s name and employer identification number (EIN) at the top of the form. This is crucial for identifying the organization in IRS records.

- Indicate the type of return being filed, such as initial return, final return, or amended return, by checking the appropriate box.

- Fill in the address details, ensuring to include room or suite numbers along with the city, state, and ZIP code.

- Complete the organizational type section by selecting the correct designation based on the organization's tax-exempt status.

- Report contributions, gifts, grants, and similar amounts received by filling out the corresponding fields, making sure to add totals correctly.

- Detail the organization's program service accomplishments in Part III. This is an important section to showcase the foundation's impact and ongoing initiatives.

- Complete the functional expenses section by categorizing expenses into program services, management and general, and fundraising.

- Fill out the balance sheet section in Part IV, detailing the organization’s assets and liabilities.

- Check to ensure all fields are filled out correctly and verify the data entered matches the organization’s financial records.

- Once all the appropriate sections have been completed, save the changes made to the document.

- Download, print, or share the form as necessary for submission to the IRS and retain a copy for your records.

Start filling out the Clinton Foundation IRS 990 Form online today to ensure timely and accurate reporting.

You can find Foundation 990s on platforms like the IRS website, GuideStar, or the Foundation Center. These resources compile 990 forms, including those for the Clinton Foundation, making it easy for you to access relevant financial details. These platforms ensure you can stay informed about nonprofit organizations' activities and finances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.