Loading

Get Wh 1 Statement Of Citizenship And Federal Tax Status Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WH-1 Statement Of Citizenship And Federal Tax Status Form online

Completing the WH-1 Statement Of Citizenship And Federal Tax Status Form is an essential step in ensuring compliance with federal tax regulations. This guide provides clear instructions on how to fill out the form online, tailored for users with varying levels of experience.

Follow the steps to complete the WH-1 form accurately.

- Click ‘Get Form’ button to access the WH-1 Statement Of Citizenship And Federal Tax Status Form and open it in your chosen online platform.

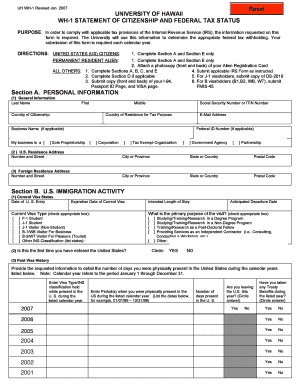

- In Section A, provide your personal information, including your last name, first name, middle name, country of citizenship, Social Security Number or ITIN, country of residence for tax purposes, email address, and any applicable business information.

- Complete Section A(2) by entering your U.S. residence address, including the number and street, city or province, state or country, and postal code, along with your foreign residence address if applicable.

- Move to Section B and fill out your U.S. immigration activity. Enter your current visa status, U.S. entry date, expiration date of your current visa, intended length of stay, and anticipated departure date. Select the current visa type and the primary purpose of your visit.

- In Section C, complete the Substantial Presence Test (SPT). Follow the instructions to calculate the number of days present in the U.S. for the relevant years and answer the questions regarding your presence.

- If you marked YES to the SPT questions, proceed to Section E to certify that the information provided is accurate and sign the form. If not, complete Section D to claim any exemptions from federal tax withholding if applicable.

- Once all sections are completed, review the form for accuracy. You can then save changes, download a copy, print the form for your records, or share it as needed.

Start filling out your WH-1 Statement Of Citizenship And Federal Tax Status Form online today!

If you don't submit the W-8BEN form, U.S. payers may withhold taxes at a higher rate on your income. This could lead to significant deductions from your earnings. To prevent excessive taxation and ensure compliance, completing the Wh 1 Statement Of Citizenship And Federal Tax Status Form is essential.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.