Loading

Get St12b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St12b online

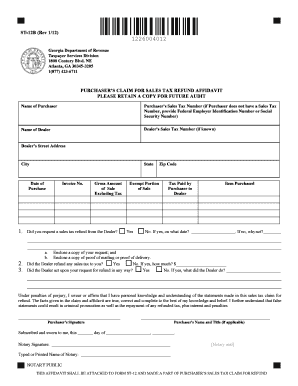

Filling out the St12b form is crucial for individuals seeking a sales tax refund in Georgia. This guide provides a clear, step-by-step approach to help you accurately complete the form online.

Follow the steps to successfully complete your St12b form.

- Press the ‘Get Form’ button to obtain the St12b form and open it in your preferred online editor.

- Begin filling in the 'Name of Purchaser' field with the full name of the individual or entity requesting the refund. Ensure accuracy as this information will be used for verification.

- Next, complete the 'Name of Dealer' with the full name of the dealer from whom the purchase was made. If you have the dealer’s sales tax number, include it in the next field.

- Fill in the 'Dealer’s Street Address', along with the city, state, and zip code. Accurate address details will facilitate processing your refund request.

- Enter the 'Invoice No.' for easy identification of the purchase. This helps both you and the dealer reference the transaction.

- Respond to whether you requested a sales tax refund from the dealer. If yes, note the date. If no, provide your reasoning.

- Complete the 'Exempt Portion of Sale' and 'Tax Paid by Purchaser to Dealer' fields, detailing the applicable portions of the sale.

- If applicable, indicate if the dealer refunded any sales tax and specify the amount. Offer details on whether the dealer acted on your refund request.

- Finally, ensure that a notary subscribes and witnesses your affidavit section as required. This includes the notary's signature and seal.

Complete your St12b form online today to initiate your sales tax refund request.

Related links form

The term 12B commonly refers to specific tax forms like the ST12B, which serve distinct purposes in tax management. This form helps individuals claim certain tax exemptions applicable in various states. Understanding its function can aid you in optimizing your tax filings effectively. If you need assistance, resources like US Legal Forms provide valuable information about the 12B form and its benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.