Loading

Get Hawaii Hw 2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hawaii HW-2 Form online

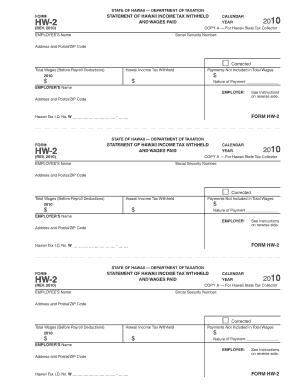

The Hawaii HW-2 Form is an essential document used to report income tax withheld and wages paid to employees in the state of Hawaii. This guide provides clear, step-by-step instructions for successfully completing this form online, ensuring that users can navigate it with confidence.

Follow the steps to complete the Hawaii HW-2 Form online effectively.

- Press the ‘Get Form’ button to access the HW-2 Form and open it in your browser.

- Fill in the employee's name in the designated field. Ensure that the spelling matches their identification documents to avoid any discrepancies.

- Enter the employee's address along with the postal/ZIP code. Accurate information is crucial for correct processing.

- Provide the employee's Social Security number in the appropriate section. This number is vital for tax identification purposes.

- Indicate whether the form is corrected by checking the relevant box, if applicable.

- Input the total wages paid before any payroll deductions. This amount reflects the gross salary earned by the employee.

- Enter the total amount of Hawaii income tax withheld from the employee's wages. If no amount was deducted, write 'none' or '0'.

- Detail any payments not included in total wages as needed, explaining the nature of these payments in the designated area.

- Input the employer's name, address, postal/ZIP code, and Hawaii Tax Identification Number to complete the employer information section.

- Review all entries for accuracy. Once confirmed, save your changes to the form.

- Download, print, or share the completed HW-2 Form as required for submission to the appropriate parties.

Complete your Hawaii HW-2 Form online today to ensure a smooth and efficient filing process.

Yes, a Hawaii tax return can be filed electronically. The state encourages electronic filings for its convenience and efficiency. Platforms like US Legal Forms can facilitate this process, allowing you to file your Hawaii Hw 2 Form and other necessary documents securely online. Ensure that you meet all filing deadlines to avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.