Loading

Get 2012 Fillable W3 City Reconciliation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Fillable W3 City Reconciliation Form online

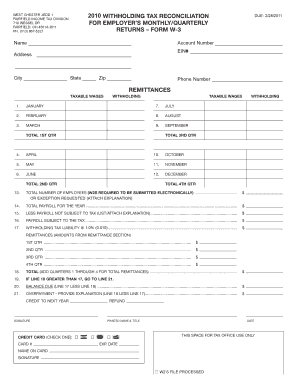

Filling out the 2012 Fillable W3 City Reconciliation Form online can streamline your tax reporting process and ensure compliance with local regulations. This guide provides clear, step-by-step instructions to help you complete the form accurately.

Follow the steps to successfully complete the form online.

- Use the ‘Get Form’ button to access the form and open it in your chosen editor.

- Begin by entering the name of the entity in the designated field. Ensure that it matches your business records accurately.

- Input the Employer Identification Number (EIN) in the corresponding section. Double-check for accuracy as this is a critical identifier.

- Provide your account number in the specified field to facilitate proper identification.

- Fill in your address, including the city, state, and zip code. This information should reflect your business's official location.

- Enter your phone number, as it may be needed for follow-up regarding your submission.

- Proceed to list taxable wages for each month in the remittances section. Make sure to fill in January through December with accurate figures.

- Calculate and enter the total payroll for the year and any payroll not subject to tax in the corresponding fields.

- Determine and input your withholding tax liability based on the taxable wages provided.

- Document your remittances for each quarter, ensuring that the amounts are correct and correspond to previous entries.

- Finally, review all entered information for any errors or omissions before saving, downloading, printing, or sharing the completed form.

Complete your forms online for faster processing and greater accuracy.

Companies should reconcile the W3 with all corresponding W-2 forms submitted for their employees. This ensures that total incomes and withheld taxes match across documents, reducing the risk of IRS discrepancies. Completing the 2012 Fillable W3 City Reconciliation Form simplifies the reconciliation process. For a reliable solution, tools available on uslegalforms can guide you through accurate reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.