Get 3013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3013 Form online

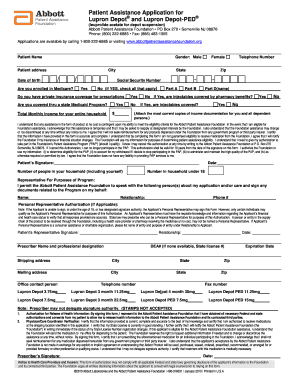

Filling out the 3013 Form online is a straightforward process designed to assist individuals in obtaining essential medication through the Abbott Patient Assistance Foundation. This guide will outline each step to ensure your application is complete and submitted correctly.

Follow the steps to successfully complete the 3013 Form online.

- Click ‘Get Form’ button to access the 3013 Form and open it in your preferred online editor.

- Begin by entering the patient's name and details, including date of birth, address, and contact information. Ensure all fields are accurately filled out, as incomplete information may delay processing.

- Indicate the patient's insurance status by answering questions about Medicare enrollment and other insurance coverages. Attach required income documentation for all household members, including tax returns or pay stubs.

- Complete the sections for patient consent, ensuring the patient or their representative provides the necessary signatures and dates. If applicable, include details of the representative authorized to interact with the foundation on behalf of the patient.

- Have the prescriber fill out their section, including their signature and date. They must confirm the accuracy of the information and verify their authority to prescribe the requested medication.

- Review the entire form for any missing or incorrect information. It is essential that all sections are complete to avoid delays in processing.

- Once all information has been verified, save your changes. You may choose to download a copy for your records or print the form directly.

- Submit the completed application along with all necessary documentation via fax or mail to the Abbott Patient Assistance Foundation using the provided contact information.

Start filling out the 3013 Form online today to access the assistance you may need.

The calculation of franchise tax in Texas depends on the gross receipts of your business and the applicable rate. Generally, entities with less total revenue than a specified amount may not owe any tax. To accurately calculate your tax, you will need to use the 3013 Form, which helps you determine your revenue and tax rate. For a seamless experience, US Legal Forms offers tools and resources to assist you with your calculations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.