Loading

Get Form Sc8857

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Sc8857 online

This guide provides a comprehensive overview for users on how to complete the Form Sc8857 online. By following these steps, individuals seeking innocent spouse relief can easily navigate the form and ensure accurate submission.

Follow the steps to fill out the Form Sc8857 effectively.

- Click the ‘Get Form’ button to download the form and open it in your preferred document editor.

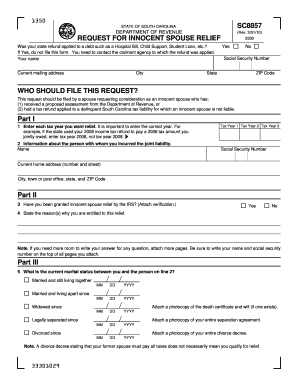

- In the section for your personal information, enter your name, current mailing address, and Social Security Number. Ensure that the address is complete with city, state, and ZIP code.

- Review the eligibility criteria carefully to determine if you should file this request, specifically noting if your state refund was applied to a debt.

- In Part I, list the tax years for which you are seeking relief. Include the correct year associated with the refund, rather than the year in which you filed the return.

- Fill in the details regarding the individual with whom you incurred the joint liability, providing their name, Social Security Number, and current address.

- In Part II, answer the question about whether you have received innocent spouse relief from the IRS, attaching any necessary verification.

- Clearly articulate the reasons you believe you are entitled to relief on the form, ensuring you provide sufficient information.

- In Part III, indicate your current marital status and provide the relevant dates. Attach documentation if necessary, such as a death certificate for widow/er status or divorce decree.

- Respond to the questions regarding if you were a victim of spousal abuse or if you signed the returns under duress, including explanations and documentation as required.

- Describe your involvement in preparing the tax returns and household finances in Part IV, checking all applicable statements and providing details where necessary.

- In Part V, report the number of individuals in your household, including both adults and children. Then, provide a comprehensive overview of your average monthly income and expenses.

- Conclude by offering any additional information that may support your claim for relief, and ensure all pages of attached documents carry your name and Social Security Number.

- Finally, sign and date the form, providing your daytime telephone number and email address. Ensure that any preparer's information is also completed if applicable.

- Once you have filled out the form, review it for accuracy, then save your changes. You can download it for printing or share it as needed.

Start filling out the Form Sc8857 online today to seek the relief you deserve.

Form 8857 is suitable for individuals who believe they should not be held responsible for a tax debt due to their relationship with the taxpayer. This includes those who have been spouses or partners of the primary taxpayer and wish to seek relief from joint tax liabilities. Using the US Legal Forms platform can simplify the preparation and filing process for Form 8857.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.