Loading

Get Calhfa Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calhfa Forms online

This guide provides detailed instructions on how to accurately complete the Calhfa Forms online. Following these steps will help ensure that your application is processed smoothly and efficiently.

Follow the steps to complete your Calhfa Forms online.

- Click ‘Get Form’ button to access the form and open it in the required editor.

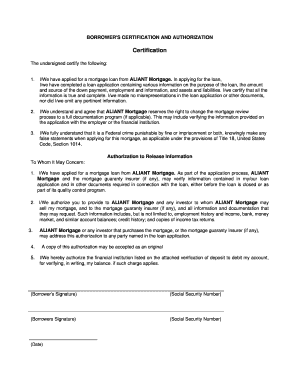

- Begin with the Certification section, where the primary borrower and any co-borrower must confirm their mortgage application details, including loan purpose, amount, and all information reported in the application. Ensure that all information is truthful and complete.

- Proceed to the Authorization section. Here, the borrower must authorize ALIANT Mortgage and any related third parties to verify the information provided. Fill in the required information pertaining to employment history, income, and any other relevant documentation.

- If applicable, complete the sections concerning the borrower's rights to a copy of the appraisal report and the consumer credit report. Make sure you initial these sections to acknowledge your understanding.

- Complete the Employment Certification by confirming employment status. Ensure that the applicant’s current employment is correctly represented and notify your loan officer of any changes before finalizing the loan.

- Review all information for accuracy, ensuring that all borrower's and co-borrower’s signatures and social security numbers are correctly entered and signed.

- Save changes made to the form. You can download, print, or share the completed form as needed.

Complete your Calhfa Forms online today to get started on your mortgage journey.

To qualify for CalHFA assistance, the property must be located in California. Additionally, the property should be a single-family home, a condominium, or a three- to four-unit property. It's essential that the home is intended as the borrower's primary residence. Understanding these requirements helps streamline your Calhfa Forms and ensures you meet eligibility criteria.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.