Loading

Get Fsa 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fsa 2002 online

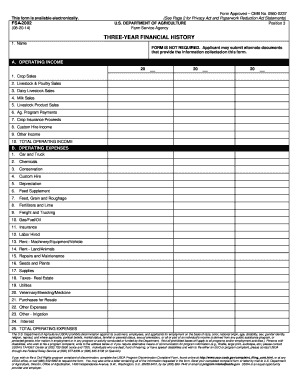

The Fsa 2002 form is a critical document used to provide a three-year financial history for agricultural operations. This guide will walk you through the process of completing the form online, ensuring you understand each section and field.

Follow the steps to complete the Fsa 2002 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing application.

- Begin with the section titled 'A. Operating Income'. Here, you will need to input values for various sources of income such as crop sales, livestock sales, and other income streams. Make sure to total these values in the 'TOTAL OPERATING INCOME' field.

- Proceed to 'B. Operating Expenses'. List all relevant expenses, including categories like labor hired, rent, utilities, and more. Ensure each entry is accurately filled out, concluding with the 'TOTAL OPERATING EXPENSES'.

- Move on to 'C. Non-Operating'. This section includes aspects like owner withdrawal, income taxes, and non-farm income. Fill in the respective amounts to provide a complete financial overview.

- Complete the 'D. Financing' section detailing your loans and payments. Make sure to enter amounts for term principal payments and any operating loan advances.

- Next, navigate to 'E. Capital'. Document your capital sales, contributions, expenditures, and withdrawals as specified.

- In the final section, 'F. Signature', you will certify that the information provided is true and complete by signing and dating the form.

- After filling out all sections, remember to save your changes, and then you can download, print, or share your completed form as needed.

Get started on completing your Fsa 2002 online today!

The most common mistake when completing the FAFSA involves incorrect social security numbers. Submitting an application with a wrong number can lead to significant delays in processing your FSA 2002. Always double-check that the social security numbers match those on your documents. For more help, USLegalForms provides great resources to ensure every detail is correct and your submission goes smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.