Get W-8 Form - Business Services - University Of Arkansas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-8 Form - Business Services - University Of Arkansas online

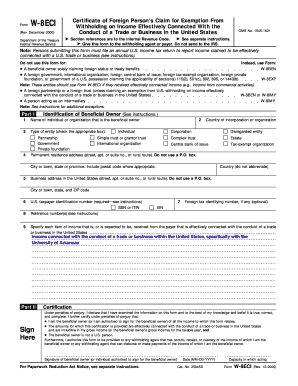

Filling out the W-8 Form is an essential step for foreign entities claiming exemption from U.S. income withholding on earnings effectively connected with a trade or business in the United States. This guide will provide you with a clear and supportive walkthrough of the form's components, ensuring you can complete it accurately and efficiently online.

Follow the steps to successfully complete the W-8 Form online.

- Click ‘Get Form’ button to obtain the W-8 Form and open it for editing.

- In Part I, provide the name of the beneficial owner in the designated field, whether it's an individual or organization.

- Select the type of entity from the available options by checking the appropriate box. Options include partnership, corporation, or private foundation, among others.

- Fill in the country of incorporation or organization in the specified field to indicate where the business is registered.

- Enter the permanent residence address, ensuring it includes the street address, city or town, state or province, and postal code, avoiding the use of a P.O. box.

- Provide the business address in the United States, including the street address, city or town, and ZIP code, also avoiding the use of a P.O. box.

- Enter the U.S. taxpayer identification number, which is required to complete this form. If applicable, you may also include a foreign tax identifying number.

- Specify each item of income expected to be received that is effectively connected with the conduct of a trade or business in the United States, particularly regarding the University of Arkansas.

- In 'Part II - Sign Here,' read the certification statement carefully and ensure you understand the declarations made regarding ownership and income. Subsequently, sign and date the form.

- Once all sections are completed, review your form for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Begin filling out your W-8 Form online today to ensure compliance and claim your tax exemptions.

Yes, the University of Arkansas is a 501c3 nonprofit organization, which allows it to operate with certain tax advantages. This designation supports the university's mission to provide education and services to students and the community. Understanding this classification can be beneficial for donors or businesses looking to support the university through contributions or partnerships. For more insights into how the university's nonprofit status impacts funding and services, explore the business services available.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.