Get Ncdordownloadse585 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ncdordownloadse585 Form online

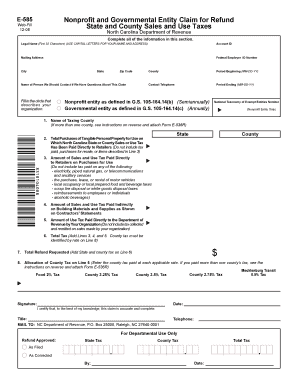

The Ncdordownloadse585 Form is essential for non-profit and governmental entities seeking a refund for sales and use taxes paid in North Carolina. This guide will provide you with clear, step-by-step instructions on how to accurately complete the form online, ensuring a seamless filing process.

Follow the steps to fill out the Ncdordownloadse585 Form online

- Press the ‘Get Form’ button to obtain the Ncdordownloadse585 Form and open it in the editor.

- Begin by completing the section that requires your legal name, using capital letters for both your name and address. Ensure the first 32 characters accurately reflect the entity name.

- Next, enter the account ID for your organization. This is a required field for processing your claim.

- Provide your mailing address, including city, state, and zip code to ensure any correspondence is directed to the correct location.

- Input the Federal Employer ID Number, which identifies your organization for federal tax purposes.

- Designate a contact person for any inquiries related to your claim. Enter their name in the appropriate field.

- Select the circle that describes the type of entity you represent—non-profit or governmental—as defined in the respective statutes.

- Fill in the period for which you're claiming the refund, specifying the start date MM-DD-YY and end date MM-DD-YY.

- Provide a contact telephone number where you can be reached for further communication.

- List the taxing county name, ensuring to attach Form E-536R if applicable to identify multiple counties.

- Enter the total purchases of tangible personal property on which North Carolina state or county sales or use tax was paid directly to retailers.

- Specify the amount of sales and use tax paid directly to retailers on those purchases.

- Detail the amount of sales and use tax paid indirectly on building materials and supplies as shown on contractor's statements.

- Input the amount of use tax that your organization paid directly to the Department of Revenue.

- Calculate the total tax by adding the amounts from Lines 3, 4, and 5, ensuring to identify the county tax rate on Line 8.

- Finally, state the total refund requested, which should include both state and county tax from Line 6.

- Allocate the county tax included in Line 6 to the applicable rates, ensuring that this matches Form E-536R if necessary.

- Review the entire document for accuracy, then sign and date the form. Ensure the title and telephone number of the individual signing are also provided.

- Once completed, save your changes and proceed to download, print, or share the form as needed.

Begin your document filing process by completing the Ncdordownloadse585 Form online.

When filing taxes by mail in North Carolina, the required forms typically include the Ncdordownloadse585 Form along with your federal tax documents. Ensure that you have all necessary attachments and supporting documents before sending them. It’s beneficial to double-check the most current requirements on the NC Department of Revenue website for any updates. For a smooth filing experience, consider using online services that guide you through this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.