Loading

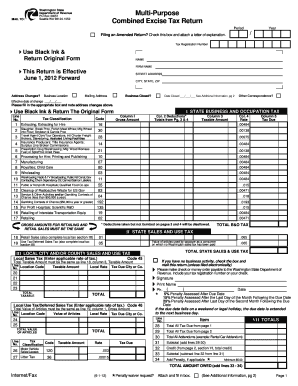

Get Washington Combined Excise Tax Return Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Washington Combined Excise Tax Return Fillable Form online

Filling out the Washington Combined Excise Tax Return Fillable Form online can streamline your tax reporting process and ensure compliance with state tax regulations. This guide provides a step-by-step approach to help you efficiently complete this form.

Follow the steps to properly complete your combined excise tax return online.

- Click 'Get Form' button to obtain the form and open it in your browser.

- Fill in the tax identification information at the top of the form, including your name, firm name, and tax registration number. Ensure all details are accurate.

- Indicate the period for which you are filing, including the year. If you are filing an amended return, check the appropriate box and provide a letter explaining the changes.

- Enter your business location and mailing address. If there have been changes, indicate those in the designated areas.

- Complete the section on the state business and occupation tax, entering the gross amounts and tax classifications according to your business activities.

- If applicable, report any deductions you are claiming by transferring totals from pages 3 and 4 of the form, ensuring that you comply with the regulations on allowable deductions.

- Complete all necessary sections regarding additional taxes, such as lodging and other applicable local and state taxes, ensuring you calculate the total tax due accurately.

- Sign and date the form at the bottom, confirming the accuracy of your provided information. Make sure to return the original signed form.

- Save your changes, then download, print, or share the completed form as necessary to submit your taxes.

Ensure you complete your Washington Combined Excise Tax Return Fillable Form correctly to avoid penalties. Start filing online today!

While related, Washington excise tax and B&O tax are not the same. The excise tax is a tax on the sale of products and services, while B&O tax is a tax on the gross receipts of your business. Both taxes are included in the Washington Combined Excise Tax Return Fillable Form, allowing you to manage your tax obligations in one streamlined document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.