Loading

Get Form 5768 Rev 9 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5768 Rev 9 2009 online

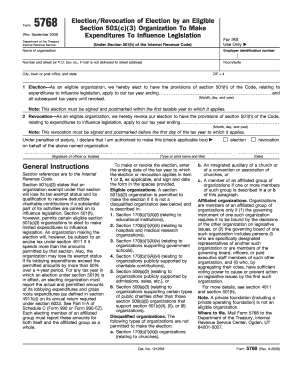

Filling out Form 5768 Rev 9 2009 is essential for eligible section 501(c)(3) organizations that wish to make or revoke an election regarding their ability to influence legislation. This guide provides clear, step-by-step instructions to assist you in completing the form online with ease and confidence.

Follow the steps to successfully complete Form 5768 Rev 9 2009 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide the name of your organization and the employer identification number (EIN). These details are essential for identifying your organization.

- Enter the address of your organization in the specified fields, including the number and street (or P.O. box), room/suite if applicable, city or town, state, and ZIP code.

- For the election, mark the appropriate box to indicate that you wish to elect section 501(h). Enter the tax year ending date you wish this election to apply to.

- If you are revoking the election, check the revocation box and provide the applicable tax year ending date.

- Under the penalties of perjury statement, ensure that an authorized person signs and dates the form. Select the appropriate title or role for the individual signing.

- Finally, review all the filled information for accuracy. You can then save changes, download, print, or share the form as needed.

Start completing your Form 5768 online today to ensure your organization meets compliance requirements.

Taxpayers that want to withdraw their Form 8832 change in entity classification may do so by sending a letter to the attention of the Entity Control Unit at the IRS Service Center in Ogdon, Utah. The taxpayer's letter needs to cite IRM Part 3.13. 2.26.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.