Loading

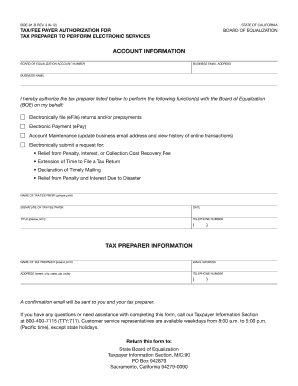

Get State Board Of Equalization Boe 91 B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Board Of Equalization Boe 91 B online

Filling out the State Board Of Equalization Boe 91 B form online is a straightforward process. This guide will provide you with clear, step-by-step instructions to ensure that you complete and submit the form accurately.

Follow the steps to complete the Boe 91 B form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your Board of Equalization account number in the designated field. This is essential for identifying your account accurately.

- Provide your business email address, ensuring it is valid to receive confirmation communications.

- Fill in your business name exactly as it appears in your official records.

- Authorize your tax preparer by checking the services they are permitted to perform on your behalf, such as e-filing returns, electronic payments, and account maintenance.

- List the name of the tax/fee payer, and include their printed signature to confirm authorization.

- Input the date of signing and the title of the tax/fee payer.

- Enter the telephone number of the tax/fee payer, formatted correctly with area code.

- Provide the name, email address, and physical address of the tax preparer, ensuring all details are complete and accurate.

- Complete the tax preparer's telephone number as you did with the tax/fee payer’s number.

- After filling out all fields, review the form for accuracy.

- Once you are satisfied with the information provided, save your changes and download or print the form as needed for your records or future submissions.

Complete your documents online today for a seamless filing experience.

A letter from the FTB can serve various purposes, such as notifying you of a tax liability, a required action, or an update regarding your account. It's crucial to review these letters carefully, as they often contain deadlines or vital information that requires your attention. For further clarification, consider consulting the State Board Of Equalization Boe 91 B, which provides essential insights and resources for handling these communications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.