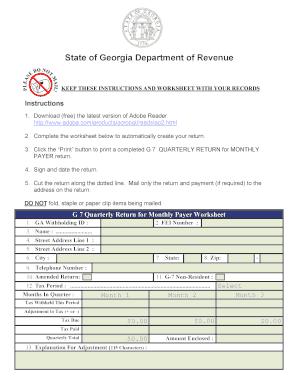

Get G7 Quarterly Return For Monthly Payer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G7 Quarterly Return For Monthly Payer Form online

Filing the G7 Quarterly Return For Monthly Payer Form correctly is essential for compliance with Georgia's tax regulations. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users can navigate the process easily.

Follow the steps to effectively complete your G7 Quarterly Return Form

- Click the ‘Get Form’ button to obtain the G7 Quarterly Return For Monthly Payer Form and open it in the designated online platform.

- Fill in your GA Withholding ID. This is a unique identifier assigned to you by the state.

- Enter your name in the designated field.

- Provide your street address, including both lines if necessary. Accurate address details ensure correspondence can be directed appropriately.

- Input your city and state. Ensure that the state is specified as Georgia.

- Fill in your zip code to complete your address information.

- Enter your FEI (Federal Employer Identification) Number. This number is required for processing your return.

- Include your telephone number for any follow-up communications.

- If applicable, indicate whether this is an amended return by checking the appropriate box.

- For non-resident withholding, check the G-7 Non-Resident box if it applies.

- Specify the tax period for which you are filing the return.

- Complete the monthly sections by providing the total tax withheld for each month in the specified blocks.

- If applicable, enter any adjustments to tax in the designated block, indicating whether it is an increase or decrease.

- Calculate and enter the total tax due for the quarter, along with the tax paid.

- Finally, review all information for accuracy, then save changes, download, print, or share the completed form as needed.

Ensure your compliance by completing your G7 Quarterly Return For Monthly Payer Form online today!

To fill out your tax withholding form correctly, start by determining the correct withholding amount based on your financial situation. Be sure to use the G7 Quarterly Return For Monthly Payer Form for reporting. This form provides clear guidance on how to calculate your withholding, ensuring you meet your obligations without overpaying. If you are unsure, consider seeking assistance through the US Legal Forms platform, which offers resources and tools for accurate completion.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.