Loading

Get Form Ui Ha

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ui Ha online

Filling out the Form Ui Ha online ensures a streamlined process for household employers to report unemployment insurance contributions. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Form Ui Ha online.

- Click 'Get Form' button to obtain the form and open it in the editor.

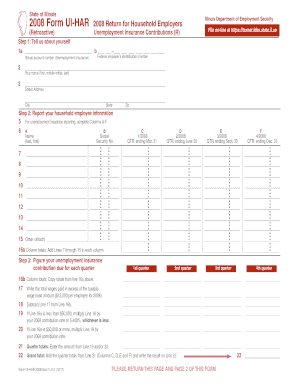

- In Line 1a, enter your 7-digit Illinois Unemployment Insurance Account Number. In Line 1b, input your nine-digit Federal Employer's Identification Number (FEIN) assigned by the Internal Revenue Service.

- In Line 2, provide your first name, middle initial, and last name.

- For Line 3, enter the street address, including city, state, and zip code where you want to receive this form.

- If you had more than eight household employees during 2008, use an additional sheet of paper to include their information in Step 2 for each additional worker. Total Columns C through F on the attachment and write the totals on Line 15 in the appropriate column.

- In Line 16a, add Lines 6 through 15 within each column. This will give you the total wages paid for each quarter.

- For Line 16b, copy the totals from line 16a.

- In Line 17, calculate the total wages paid in excess of the unemployment insurance taxable wage base amount for each worker, noting that for 2008, this amount is $12,000.

- In Line 18, subtract Line 17 from Line 16b and enter the result. This represents your taxable wages.

- Calculate your unemployment insurance contributions for each quarter. Complete either Line 19 or Line 20, depending on your situation.

- In Line 21, sum the quarterly totals from Line 21 (Columns C, D, E, and F) and enter the result on Line 22. This is your total unemployment insurance contributions due for 2008.

- For Lines 27 to 29, write the total 2008 unemployment insurance contributions from Line 22. If applicable, enter any previous payments made. Subtract to find the amount due.

- If you have stopped employing workers, write the date of the last day you employed them in Line 31.

- Finally, ensure you sign the form, confirming that the information provided is true and complete.

Complete and submit your Form Ui Ha online today to ensure compliance and timely processing.

Filing an unemployment tax form can be straightforward when you follow the right steps. First, gather all necessary information, such as your employment history and income details. Then, use the appropriate online platform, like USLegalForms, to access the Form Ui Ha feature that guides you through the filing process, ensuring everything is completed correctly and submitted on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.