Loading

Get Instructions - Form Ftb 540 - 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions - Form FTB 540 - 2003 online

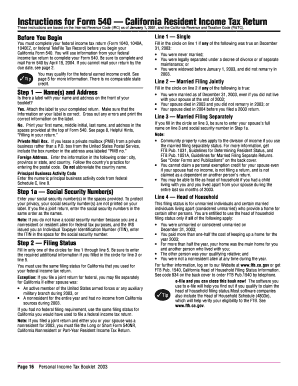

This guide provides a comprehensive overview of how to complete the Instructions - Form FTB 540 - 2003 online. Following these instructions will help ensure that you fill out the form accurately and submit it on time.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Complete your federal income tax return before starting Form 540, as you will need data from it.

- Fill in your name and address at the top of Form 540. If you have a label, you can attach it.

- Provide your Social Security number in the designated spaces, ensuring the order matches your names if filing jointly.

- Select your filing status by filling in only one of the circles for lines 1 through 5 based on your relationship status as of December 31, 2003.

- Enter the total amount of your exemptions on line 11, following the instructions for personal, blind, and senior exemptions.

- Calculate your taxable income by entering your total wages and making any necessary California adjustments.

- Complete the tax calculation on lines 20 through 30, making sure to apply any relevant credits.

- Fill out the payments section, ensuring all tax withholdings are accurately reported.

- Review the entire form for accuracy and completeness before submitting or saving your changes.

- Once finished, you can save your changes, download, print, or otherwise share the completed form as needed.

Start filling out your Instructions - Form FTB 540 - 2003 online now to ensure accurate filing.

Generally, tax-exempt interest is not subject to California state income tax, but there are exceptions. Investments like municipal bonds might provide income that is not taxed, while others may be partially taxable. To clarify your status, it’s crucial to review the Instructions - Form FTB 540 - 2003. You can find helpful examples and forms on US Legal Forms to ensure you understand your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.