Loading

Get Ny Ct 2658 E 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ny Ct 2658 E 2012 Form online

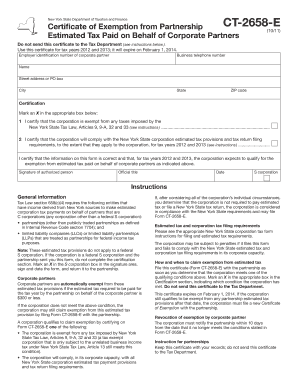

Filling out the Ny Ct 2658 E 2012 Form is an important step for corporations seeking exemption from estimated tax payments on behalf of corporate partners. This guide provides a clear and supportive approach to help you navigate the form effectively and accurately.

Follow the steps to complete the Ny Ct 2658 E 2012 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Enter the employer identification number of the corporate partner in the designated field.

- Provide the business telephone number in the appropriate section under contact details.

- Fill out the name of the corporation in the space provided.

- Complete the address fields, including street address or PO Box, city, state, and ZIP code.

- In the Certification section, mark an X in the box that corresponds to the exemption condition your corporation qualifies for.

- Ensure that the information on the form is complete and accurate before signing.

- Include the signature of an authorized person, their official title, and the date on which the form is signed.

- Review all entered information to confirm accuracy and completeness.

- Once satisfied, save changes, and choose to download, print, or share the completed form as necessary.

Start filling out the Ny Ct 2658 E 2012 Form online today!

New York State encourages taxpayers to e-file their tax returns, including the NY Ct 2658 E 2012 Form, due to its numerous benefits. While electronic filing is not mandatory for all taxpayers, it is recommended for its ease, speed, and accuracy. Therefore, familiarize yourself with e-filing options to streamline your tax experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.