Loading

Get Wisconsin Department Of Revenue Form 4h

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Department Of Revenue Form 4h online

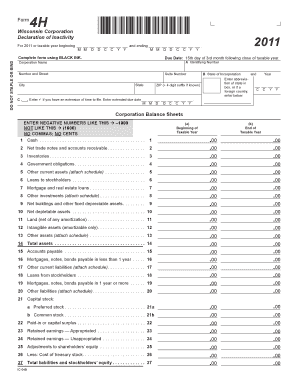

Filling out the Wisconsin Department Of Revenue Form 4h online is a straightforward process designed to assist corporations that have been inactive during their taxable year. This guide will walk you through each step to ensure you complete the form accurately and efficiently.

Follow the steps to fill out Form 4h correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the identifying number, either your federal employer identification number (EIN) or Wisconsin tax number (WTN), clearly in the designated field.

- Fill in the corporation name, address, and state of incorporation. Make sure to include the ZIP code, as well as any extension details if applicable.

- Complete the balance sheets for the first and last day of the taxable year. List all cash, receivables, inventories, and any other current and fixed assets.

- For liabilities, include all accounts payable, current liabilities, and any long-term debts. If any line item on your balance sheet does not apply, enter zero (0) where applicable.

- Record the stockholder's equity, including capital stock, paid-in surplus, and retained earnings, making sure to classify them appropriately.

- Ensure that an authorized officer signs the form. If no officers are residents of Wisconsin, any duly authorized officer may sign.

- Review the form for accuracy and completeness. When all fields are filled out correctly, save your changes. You can then choose to download, print, or share the completed Form 4h.

Start completing your Form 4h online today for a seamless filing experience.

You should mail your Wisconsin state tax return to the address specified on your Wisconsin Department Of Revenue Form 4h. This address can vary based on whether you owe taxes or are expecting a refund. For the latest and specific mailing guidelines, check the Wisconsin Department of Revenue website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.