Loading

Get Va 8453c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 8453C Form online

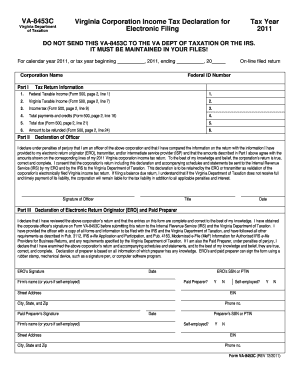

Filling out the VA 8453C Form is essential for corporate officers submitting their Virginia Corporation Income Tax return electronically. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the VA 8453C Form online.

- Click the ‘Get Form’ button to access the VA 8453C Form online and open it in your editing interface.

- Enter the name of the corporation in the designated field, ensuring the name is correctly printed or typed.

- Input the Federal Employer Identification Number (FEIN) in the appropriate space.

- Check the box marked 'On-line filed return' only if the return is being filed by the corporate officer via the Internet.

- In Part I, provide the necessary tax return information by entering the amounts from your Form 500, including Federal Taxable Income, Virginia Taxable Income, Income Tax, Total Payments and Credits, Total Due, and Amount to be Refunded.

- In Part II, the corporate officer must declare their responsibility for the accuracy of the returns and sign the form, including their title and date of signature.

- If applicable, have the Electronic Return Originator (ERO) complete Part III by reviewing the return and signing where indicated. They can use a rubber stamp, mechanical device, or computer software for the signature.

- Finally, save your changes, and consider your options to download, print, or share the completed VA 8453C Form as needed, ensuring it is retained for your records.

Start completing your VA 8453C Form online today!

You can print tax forms at home using a standard printer. For specific forms like the VA 8453C Form, you can download them from official tax websites or uslegalforms. If you prefer a professional service, local print shops or office supply stores can also assist with printing your tax documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.