Loading

Get Nj W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj W4 online

Filling out the Nj W4 online is a crucial step in managing your tax withholdings efficiently. This guide will provide you with clear and supportive instructions to help you complete the form accurately and understand each component's significance.

Follow the steps to fill out the Nj W4 online correctly.

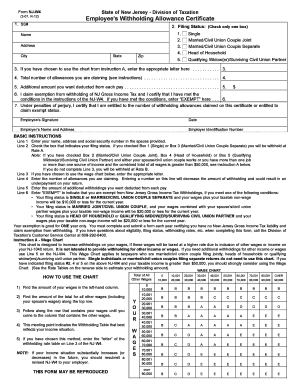

- Click the ‘Get Form’ button to access the Nj W4 form and open it in the editing interface.

- Enter your name, address, and social security number in the spaces provided on Line 1.

- On Line 2, select your filing status by checking only one box that best describes your situation: 'Single', 'Married/Civil Union Couple Joint', 'Married/Civil Union Couple Separate', 'Head of Household', or 'Qualifying Widow(er)/Surviving Civil Union Partner'.

- If you have chosen to refer to the wage chart, enter the corresponding letter on Line 3.

- Enter the total number of allowances you are claiming on Line 4. Remember, claiming more allowances reduces your withholding.

- If you would like to have additional amounts deducted from each paycheck, specify that amount in Line 5.

- If you qualify for exemption from NJ Gross Income Tax withholding, write 'EXEMPT' in Line 6.

- Certify that you are entitled to the number of withholding allowances claimed by signing and dating the form at the bottom.

- Finally, provide your employer’s name, address, and identification number as required.

- Once completed, save any changes made, and choose to download, print, or share the form as needed.

Take control of your tax withholdings by completing the Nj W4 online today.

Filling out the NJ W-4 form requires you to input your personal information, filing status, and the allowances you wish to claim. Carefully read the instructions accompanying the form to avoid mistakes. If you find the process overwhelming, platforms like UsLegalForms can provide helpful insights and tools to ensure you fill out the form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.