Loading

Get Sunshine State W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sunshine State W 9 Form online

Filling out the Sunshine State W 9 Form online can streamline your documentation process and ensure accuracy. This guide will provide you with clear, step-by-step instructions to help you complete the form effectively, even if you have limited legal experience.

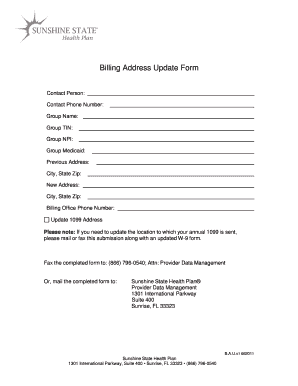

Follow the steps to complete the Sunshine State W 9 Form online

- Use the ‘Get Form’ button to obtain the Sunshine State W 9 Form and access it in your preferred online editor.

- Begin by entering your contact person's name in the designated field, ensuring it's clear and easy to read.

- Input the contact phone number below the contact person's name, using a format that includes the area code.

- Provide the group name as it appears officially, filling in this field accurately to avoid processing delays.

- Enter the group TIN (Tax Identification Number) in the appropriate section to ensure tax compliance.

- Fill in the group NPI (National Provider Identifier) where specified, as this is crucial for identification.

- Complete the group Medicaid number field to facilitate any future necessary communications.

- Provide the previous address details including street, city, state, and zip code.

- Enter the new address in the same format, ensuring that all changes are accurately documented.

- Lastly, fill out the billing office phone number for any inquiries regarding the billing updates.

- If you need to update the 1099 address, please note that you must submit a completed W-9 form along with this document.

- Once all information has been filled in correctly, save your changes, and choose whether to download, print, or share the completed form as needed.

Start completing the Sunshine State W 9 Form online now to ensure your information is up-to-date.

Yes, you primarily fill out your own Sunshine State W 9 Form. It is your responsibility to provide accurate information that will be reported to the IRS. If you need help, you can always rely on resources like uslegalforms to ensure your form is completed correctly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.